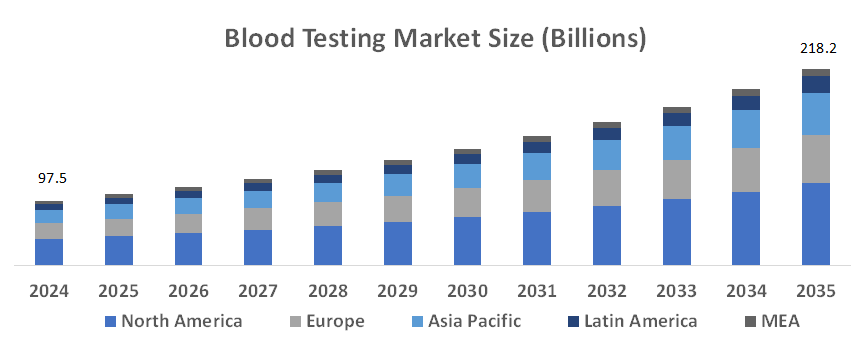

Global Blood Testing Market Set to Reach USD 218.2 Billion by 2035, with a 7.6% CAGR

Report ID: MI1028 | Industry: Healthcare

The global Blood Testing market is estimated at USD 97.5 billion in 2024 and is projected to grow at a CAGR of 7.6% from 2025-2035. The blood testing market is a healthcare industry of developing and distributing diagnostic tests that examine the analysis of blood samples, including laboratory testing, point-of-care testing, and home test kits allowing one to make early disease detection including diabetes, cardiovascular, infectious disease diagnoses, and monitoring.

It also includes technological advances such as immunoassays, molecular diagnostics, and biomarker testing. The market's growth is driven by increasing healthcare needs, an aging population, and technological innovations in testing equipment. The leading firms in the market, for instance, Abbott and Siemens Healthineers, continually improve their testing capabilities. Rising demand for personalized and accessible health solutions is expected to widen the scope of the market shortly.

To explore in-depth analysis in this report - Request Free Sample Report

What are the Top Factors Driving Growth in the Blood Testing Market?

Technological advancements in blood testing include AI, molecular diagnostics, and wearables.

Technological advancement in the blood testing market has dramatically enhanced diagnostic accuracy and efficiency. Testing at point-of-care gives quicker results outside of the laboratory, allowing immediate feedback when necessary. Molecular diagnostics improve more specific identification of genetic and infectious diseases to change the course of early diagnosis. AI boosts test data interpretation and enhances information to allow for more precise and tailored treatment. In addition, the use of wearable blood monitoring devices is becoming quite common for continuous, real-time health tracking, especially for chronic diseases such as diabetes. Such innovations are making blood testing more accessible, efficient, and valuable to patients and healthcare providers.

Chronic diseases increase globally, stressing healthcare systems and resources significantly.

The blood testing industry rides on the wave of increasingly chronic diseases. Due to the increasing prevalence of various chronic conditions such as diabetes, heart disease, or cancers, the demand for any medical diagnostic test increases significantly, and blood tests assume particular prominence in the early detection observation, and management of chronic disorders through routine blood testing: hence checking changes in biomarkers that risk factors may have assumed after treatment.

This further fuels the need for more advanced, precise, and accessible technologies that test blood. There is also an emerging trend toward personalized medicine that drives blood testing services. More and more, health systems depend on blood tests to upgrade their quality-of-care provision while reducing costs in the long run.

Browse key industry insights spread across 210 pages with 120+ Market data tables and figures & charts from the report on the “Blood Testing Market By Product Type (Reagents and Kits, Instruments, and Software), By Test Type (Complete Blood Count (CBC), Blood Glucose Test, Lipid Panel Testing, Haemoglobin A1C, BUN (Blood Urea Nitrogen) Testing, Creatinine, Cortisol, COVID-19 Tests and Others), By Application (Disease Diagnosis, Health Screening, Monitoring, and Transfusion Medicine), By Method (Manual and Automated), and By End User (Hospitals, Diagnostic Laboratories, Home Care Settings, Research Institutions, and Blood Banks), Global Market Size, Segmental analysis, Regional Overview, Company share analysis, Leading Company Profiles And Market Forecast, 2025 – 2035”

Download an Exclusive Sample of the Report: https://www.metatechinsights.com/request-sample/1028

What are the significant challenges impacting the Blood Testing Market?

The prohibitive cost of advanced testing limits accessibility, hindering market growth.

The expensive cost of advanced blood testing makes it inaccessible to most people. Many patients in deprived areas cannot afford expensive diagnostic tests. The above constraints hinder the widespread uptake of modern technologies in health systems. In turn, the need for cheaper testing continues to rise. Expensive tests also consume much-needed resources in healthcare budgets. It leaves few resources to allocate to other important services. These are some of the critical cost issues that should be addressed to ensure that access to advanced blood testing becomes wider globally.

Regulatory challenges slow innovation, complicate market entry and increase costs.

Regulatory issues in the blood testing market can limit innovation and market growth. Strict regulations, including agency approvals from the FDA or EMA, slow down the introduction of new technologies. These standards usually require rigorous testing, documentation, and clinical trials, which are expensive. This can delay the availability of breakthrough diagnostic tools. Besides, various regulations in different regions make it complicated to enter and expand the global market. It presents a great challenge to manufacturers, and it becomes impossible for them to scale fast. In some cases, the hurdle may reduce competition and innovation in the market. Still, one of the significant hurdles remains to balance safety, efficacy, and regulatory approval.

What are the attractive investment opportunities that can drive industry growth?

Home testing kits offer convenience, affordability, and increased market accessibility.

Home testing kits are a new opportunity in the blood testing market. They have more convenience because patients can run tests at home without requiring hospital visits. This option is also cheaper, thus opening a wider population to testing. With the emergence of chronic diseases and a call for continuous monitoring, the home testing kit will help to provide an efficient route to continuous health management. It also supports the growing trend for personalized healthcare, where people will be able to monitor their health on their own. At-home testing kits will be a convenience for increasing the patient's engagement with his or her treatment plan. Another advancement in technology will help the kits become more accurate and reliable. As healthcare continues to cut costs, home test kits are an inexpensive option.

Emerging markets present growth opportunities for affordable, accessible healthcare solutions.

Emerging markets offer huge opportunities to the blood testing market. With a fast increase in population and demand for healthcare, these markets still indicate a lot of untapped potential in affordable healthcare solutions. Once incomes rise and healthcare is more accessible, demand for diagnostics in general, including blood evaluations, increases. Challenges presented by these markets include poor accessibility to advanced healthcare technologies as well as prohibitive costs. Companies can bridge these gaps by providing affordable, mobile, and accessible blood testing solutions. The increasing incidence of chronic diseases in developing markets also leads to increased demand for frequent testing and early detection. Digital health solutions fuel the growth of the market even more in such regions.

North America Plays a Crucial Role in the Blood Testing Market Landscape

The North American region has been the largest market for blood testing due to the highly advanced healthcare infrastructures, high prevalence of chronic diseases, and great research and development investment in the region. Dominance by major market players and the adoption of innovative technologies have also contributed to its present dominance. A growing emphasis on preventive care and early detection of diseases also increases the demand for multiple blood tests, and hence North America stands at the apex of diagnostics. The U.S. holds the highest market share because of the well-structured regulatory system. In this region, point-of-care testing is rising very fast with rapid results, which is positively influencing patient management. The inclusion of telehealth further streamlines access to blood testing services, mainly post-pandemic. For example, The USA conducted around 4.5 million tests between February and April 2020 compared to the recommended daily test of 5–20 million.

Read more about the report: https://www.metatechinsights.com/industry-insights/blood-testing-market-1028

Asia-Pacific Holds a Significant Share of the Blood Testing Market

The Asia-Pacific region will become the most explosive for the blood testing market. Increased healthcare expenditure, a growing population, and increased awareness of health issues propel markets in the region to grow. Urbanization is at a rapid pace, and access to health care in China and India has improved significantly, thus increasing the demand for blood testing. This is further contributing to this region's boom in point-of-care testing and new diagnostic technologies. The market becomes even more attractive for expansion and investment over the coming years.

Competitive Landscape:

The Blood Testing Market is highly competitive with various featuring key players. Key operating players in the Blood Testing Market are Abbott Laboratories, F. Hoffmann-La Roche Ltd., Danaher Corporation, Siemens Healthineers Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., Becton, Dickinson and Company (BD), Grifols, S.A., Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings bioMérieux, Hologic, Inc., Sysmex Corporation, Cepheid Corporation and PerkinElmer, Inc. In October 2022, BD (Becton, Dickinson, and Company) NYSE: BDX), the world's largest medical technology company, announced a co-exclusive commercial agreement with Magnolia Medical Technologies, Inc. to reduce blood culture contamination in U.S. hospitals, thereby improving testing accuracy and clinical outcomes. This deal demonstrates the company's adherence to accuracy, which would better the clinical results and would strengthen its position in an evolving market.

Recent Developments:

- In April 2024, the FDA finalized increased regulation of lab-developed tests (LDTs), requiring these diagnostics to gain FDA authorization, which may raise costs and potentially slow innovation.

- In December 2022, the global blood testing market was valued at approximately USD 82.08 billion, with expectations of a compound annual growth rate (CAGR) of 7.88% during the forecast period.

Report Coverage:

By Product Type

- Reagents and Kits

- Instruments

- Software

By Test Type

- Complete Blood Count (CBC)

- Blood Glucose Test

- Lipid Panel Testing

- A1C (Haemoglobin A1C)

- BUN (Blood Urea Nitrogen) Testing

- Creatinine

- Cortisol

- COVID-19 Tests

- Others

By Application

- Disease Diagnosis

- Health Screening

- Monitoring

- Transfusion Medicine

By Method

- Manual

- Automated

By End User

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Research Institutions

- Blood Banks

By Region

North America

- US

- Canada

Europe

- UK.

- France

- Germany

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Sappor

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC Counties

- South Africa

- Rest of the Middle East & Africa

List of Companies

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation

- Siemens Healthineers

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- Becton, Dickinson and Company (BD)

- Grifols, S.A.

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings (LabCorp)

- bioMérieux

- Hologic, Inc.

- Sysmex Corporation

- Cepheid Corporation

- PerkinElmer, Inc.

Maximize your value and knowledge with our 5 Reports-in-1 Bundle - over 40% off!

Our analysts are ready to help you immediately.