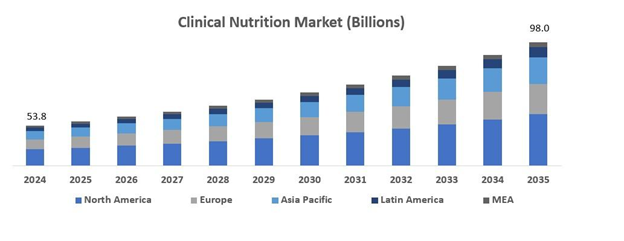

Clinical Nutrition Market Set to Reach USD 98.0 Billion by 2035, with a 5.6% CAGR

Report ID: MI1001 | Industry: Healthcare

The global clinical nutrition market size reached US$ 53.8 Billion in 2024. Going forward, the market is expected to reach US$ 98.0 Billion by 2032, exhibiting a growth rate (CAGR) of 5.6% during 2025-2035. This clinical nutrition market focuses on the supply of specialized products and services in nutrition that support specific health conditions-specific dietary needs. Healthcare is increasingly recognizing the role that nutrition plays in patient recovery and management, these products are growing in demand. The market includes clinical dieticians and nutritionists who provide consultations on personal nutrition planning. Beyond this, the growing prevalence of chronic diseases and aging populations impose a further need for effective nutritional interventions. Overall, this market of clinical nutrition is crucial in enhancing health outcomes with patient support at the appropriate levels of dietary support.

To explore in-depth analysis in this report - Request Free Sample Report

What are the Top Factors Driving Growth in the Clinical Nutrition Market?

The Rise in Diseases Happening Chronically Is Fuelling the Growth of Clinical Nutrition Products

The rise of chronic diseases now serves as a significant impetus for clinical nutrition. The World Health Organization has pointed out that cardiovascular diseases affect around 17.9 million individuals each year and are therefore the major cause of death worldwide. Diabetes also leads to about 2.0 million deaths each year, relating to complications such as nephropathy and cardiovascular conditions. Obesity and lifestyle-related disorders are increasing in prevalence, and increased awareness of nutrition in preventive health care is on the rise. This scenario creates a scenario for clinical nutrition to play a key role in improving patient outcomes, promoting innovation in product development, and expanding the scope of offerings to meet a heterogeneous patient population. Therefore, the clinical nutrition market stands for gross growth as it represents the very vital linkage between nutrition and overall management of health.

Browse key industry insights spread across 210 pages with 120+ Market data tables and figures & charts from the report on the Clinical Nutrition Market By Product Type (Oral Clinical Nutrition, Parenteral Nutrition {Carbohydrates, Parenteral Lipid Emulsion, Single Dose Amino Acid Solutions, Trace Elements, Vitamins & Minerals}, Enteral Feeding Formulas {Standard Formula, Disease-specific Formulas}), By Application (Alzheimer’s Disease, Nutrition Deficiency, Cancer Care, Diabetes, Chronic Kidney Diseases, Orphan Diseases, Dysphagia, Pain Management, Malabsorption/GI Disorder/Diarrhea, and Others), By Age Group (Paediatric, Adult, Geriatrics) And By End User (Hospitals, Retail Pharmacies, Online Pharmacies and Others), Global Market Size, Segmental analysis, Regional Overview, Company share analysis, Leading Company Profiles And Market Forecast, 2025 – 2035

Download an Exclusive Sample of the Report- https://www.metatechinsights.com/request-sample/1001

Personalized Nutrition Driven by Genetic Insights Enhances Clinical Nutrition Market Growth

Tailor-made nutritional interventions based on an individual's genetic makeup and medical conditions are also emerging as a key driver for the clinical nutrition market. Such medical interventions can, through the application of personalized medicine and genomics, provide more effective and exact nutritional support. The personalized approach not only helps in managing chronic diseases but also puts a focus on specific dietary needs to enhance overall health outcomes. Hence, awareness of personalized nutrition is increasing, and science is developing along with it. The demand for customized products and services is a matter of time and will boost the growth rate of the clinical nutrition sector considerably.

What are the significant challenges impacting the Clinical Nutrition Market?

A lengthy and challenging regulatory requirement

The issues of regulation and compliance are in clinical nutrition products that range from enteral to parenteral solutions, with the differences between various regions having strict guidelines. For instance, regulatory bodies such as the FDA and EMA regulate and have policy states for these products both for safety and efficiency in performing their function. Differences in demands from a country to another concerning demands may lead to delays in getting the product approved, high costs to manufacturers, and low penetration into the market. Furthermore, firms must cope with changes in regulatory legislation, which are sometimes unpredictable and may hinder the innovating process of the business.

High Costs and Reimbursement Challenges Limit Access to Clinical Nutrition Solutions

Clinical nutrition products are usually expensive for patients and healthcare providers to utilize, especially specialized formulations of clinical nutrition products in intensive care or chronic conditions. Most healthcare systems, especially in third-world countries, have inadequate insurance cover schemes for such products. Even in developed markets, the availability of reimbursement is often limited or inconsistent, and in this way, access to essential nutrition therapies remains challenging for many patients. These financial burdens reduce adoption rates, especially for more expensive therapies such as parenteral nutrition, and overall constrain market growth.

What are the attractive investment opportunities that can drive industry growth?

Innovation in special nutrition for chronic diseases and aging populations

Recent decades have experienced an increased trend of chronic diseases like diabetes, cancer, and cardiovascular conditions on the international spectrum. These chronic diseases require specialized clinical nutrition products to specifically address these health issues. Another very large opportunity exists regarding geriatric nutrition products because older adults face malnutrition, frailty, or other health issues related to their advancing years. This would be done through investments in custom nutrition solutions, for example, personalized medical foods, enhanced nutrient-fortified enteral formulas, and advanced parenteral nutrition systems, which help meet the specific nutritional requirements of these populations and thereby open doors for better health outcomes while tapping into an ever-increasing market segment. Companies that innovate in these areas with supporting clinical research are likely to see a high return because of an increasing focus of healthcare providers on nutrition as an integral part of disease management and prevention.

Tele-Nutrition Services Revolutionize Access to Personalized Dietary Support

Tele-nutrition services are therefore the next opportunity in the clinical nutrition industry: a remote nutritional counselling and personalization of meal planning over digital platforms. The technique is quite helpful for patients who have a limited access to health-care facilities; that one that can be found rurally or in underdeveloped areas. Technologies used by registered dieticians and nutritionists to offer very flexible consultations, ensuring that a client receives the expert guidance they require, based on his or her health condition. With tele-nutrition, one benefit is the convenience that may increase the patient's compliance with dietary advice to positively impact their health results. When telehealth is finally gaining acceptance, nutrition services are vital additions to virtual care models that can help clinical nutrition providers reach a bigger scale.

North America Offers Significant Growth Potential in the Clinical Nutrition Market

Clinical nutrition has a maximum opportunity in North America. Compared to all other chronic diseases, diabetes, obesity, and cardiovascular disorders are much more common in this region. Most of the chronic health issues have their management and prevention through clinical nutrition. Thus, demand for these products increases.

The region comprises several hospitals and healthcare facilities. Since such establishments have adequate infrastructure to provide clinical nutrition therapy, there exist further opportunities for market growth. Preventive healthcare is gaining more importance in North America.

Clinical nutrition plays a large role in preventative care plans and hence encourages people to use linked goods and services. Consumers in North America are becoming more health-conscious and knowledgeable about the value of good nutrition. That awareness increases the demand for clinical nutrition products and supplements.

Read more about the report: https://www.metatechinsights.com/industry-insights/clinical-nutrition-market-1001

Asia-Pacific Region Displays Exceptional Growth Potential in Clinical Nutrition

The clinical nutrition market is expected to grow the fastest in the Asia-Pacific region. A large part of the world's population lives within the region. The demand for clinical nutrition goods and services has been increasing due to fast urbanization and increased disposable incomes within the countries of China and India.

Asia Pacific is also facing an aging population, as is the case with most other regions. Thus, this demographic shift would drive up demand for clinical nutrition products dedicated to specific dietary needs.

The Asian consumer has recently become aware of the role diet plays in healthy preservation and the prevention of chronic diseases. With the benefits of health awareness on their minds, consumers naturally have shown an interest in clinical nutrition products and dietary supplements.

Competitive Landscape

The competition in the clinical nutrition market is significant and more competitive where each of the significant leaders is actively engaged in innovating to increase its market share. Key leaders include Nestlé Health Science, Abbott Laboratories, and Danone, which boasts a vast product portfolio covering several clinical conditions and nutritional requirements. The players in this market possess leading research and development capabilities for designing advanced formulations and personalized nutrition solutions. New entrants, and the rise in digital health platforms, are complicating this competitive landscape. Established players feature in this market alongside new players, and all are striving to be ahead of competitors through innovative products, strategic alliances, and enhanced distribution channels.

Recent Developments

- On 30th September 2024, Fresenius Kabi, an operating company specializing in biopharmaceuticals, clinical nutrition, and medical technologies, announced that the United States (U.S.) Food and Drug Administration (FDA) has approved Otulfi™ (ustekinumab-aauz), its ustekinumab biosimilar referencing Stelara®** (ustekinumab). Otulfi™ is approved for the treatment of Crohn's disease, ulcerative colitis, moderate to severe plaque psoriasis and active psoriatic arthritis.

- On 19th September 2024, US food tech company Vytala announced its official launch and the initial close of pre-seed financing. Vytala will help people with GI diagnoses achieve their best health through the power of nutrition.

Report Coverage:

By Product Type

- Oral Clinical Nutrition

- Carbohydrate

- Parenteral Lipid Emulsion

- Single Dose Amino Acid solution

- Trace Elements

- Vitamins & Minerals

- Enteral feeding formulas

- Standard formula

- Disease specific formulas

By Application

- Alzheimer’s Disease

- Nutrition Deficiency

- Cancer Care, Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia Pain Management

- Digestive Malfunction/Intestinal Disorder/Diarrheal Conditions

By Age Group

- Pediatric

- Adult

- Geriatrics

By End-user

- Hospitals

- Retail Pharmacies

- Online Pharmacies

- Others

By Region

North America

- U.S.

- Canada

Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Singapore

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East & Africa

List of Companies:

- Nestlé S.A.

- Abbott Laboratories

- Danone Nutricia

- B. Braun Melsungen AG

- Fresenius SE & Co. KGaA

- Perrigo Company PLC

- Pfizer Inc.

- Lonza Ltd.

- Baxter International Inc.

- Hero Nutritional’s Inc.

- Mead Johnson Nutrition

- Vivify Health

- Meiji Holdings Co., Ltd.

- Reckitt Benckiser

- AYMES International Ltd

- FMC Corporation

- Ketogenic

- Hershey (Hershey Nutrition)

- GNC Holdings Inc.

Maximize your value and knowledge with our 5 Reports-in-1 Bundle - over 40% off!

Our analysts are ready to help you immediately.