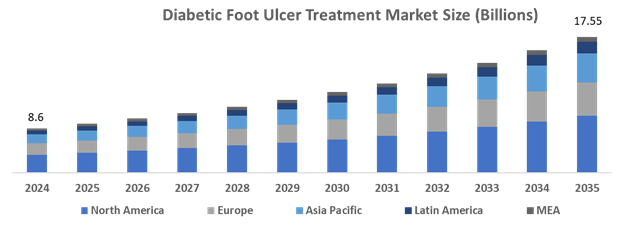

Global Diabetic Foot Ulcer Treatment Market Set to Reach USD 17.55 Billion by 2035, with a 6.7% CAGR

Report ID: MI1075 | Industry: Healthcare

The global Diabetic Foot Ulcer Treatment market is estimated at USD 8.6 billion in 2024 and is projected to grow at a CAGR of 6.7% during the forecast period 2025-2035. The diabetic foot ulcer treatment market encompasses a wide range of products, treatments, and services that are aimed at preventing, managing, and healing diabetes-associated foot ulcers. Advanced wound care dressings are also included in the marketplace, along with topical medications, restorative footwear, strong devices, and specialized treatments such as negative pressure wound treatment and hyperbaric oxygen treatment. Development in this advertisement is on account of high frequencies of diabetes, developing awareness of diabetic foot care, and development in wound administration arrangements. The main products for this segment include successful wound care and medications for diabetic foot ulcers.

To explore in-depth analysis in this report - Request Free Sample Report

What are the Top Factors Driving Growth in the Diabetic Foot Ulcer Treatment Market?

Transition from Traditional to Advanced Wound Management Products to Drive Market Growth

Advances in wound management products, shifting the focus from basic to advanced, form the major growth driver in the diabetic foot ulcer treatment market. Tradition is limited to mere dressings, which have barely anything to do with the complexities of today's diabetic foot ulcers. Advanced dressings like hydrocolloids and hydrogels have a significant contribution toward faster healing, reducing healing time by as much as 50%. They also contain antimicrobial agents that inhibit the onset of infection as the CDC reports that 14% to 24% of diabetic foot ulcers become infected, complicating recovery. Advanced wound care products incur higher direct expenses, but are said to decrease long-term costs by 20% to 30% because of the reduction of other treatments and hospitalization. Bioengineered skin substitutes and smart dressings address solutions that accelerate healing. The staggering prevalence of diabetes worldwide, almost 537 million adults, and the incidence that one in four adults will develop a foot ulcer over their lifetime, hence call for more effective management of wounds.

Browse key industry insights spread across 220 pages with 120+ Market data tables and figures & charts from the report on the “Diabetic Foot Ulcer Treatment Market By Product Type (Wound-care Dressings (Antimicrobial Dressings, Foam Dressings, Film Dressings, Alginate Dressings, Hydrogel Dressings, Other Dressings), Wound-care Devices (Negative Pressure Wound Therapy (NPWT), Ultrasound Therapy, Hyperbaric Oxygen Therapy (HBOT), Others), Active Therapies [Skin Grafts & Substitutes, Growth Factors, Others), By Ulcer Type (Neuropathic Ulcer, Ischemic Ulcer, Neuro-ischemic Ulcer), By Infection Severity (Moderate, Mild, Severe), By End-user (Hospitals, Clinics, Ambulatory Surgical Centers, Others), Global Market Size, Segmental analysis, Regional Overview, Company share analysis, Leading Company Profiles And Market Forecast, 2025-2035”

Download an Exclusive Sample of the Report- https://www.metatechinsights.com/request-sample/1075

Increasing Incidence of Diabetic Foot Ulcers to Drive Treatment Demand

Globalism that causes increased incidences of diabetes has led to a growing increase in cases of DFU, which is one of the most acute complications associated with the disorder. Critical factors influencing this process also involve aging changes in lifestyle and an increasing rate of obesity. Moreover, clinical studies have also portrayed how individuals suffering from diabetes are far more liable to develop foot ulcers than non-diabetic persons. For example, an article published by the International Wound Journal in 2023 reveals that diabetic foot ulcers have a worldwide prevalence of around 6.3%, a figure extracted from little knowledge of the same. In this regard, as its prevalence is on the increase, the need for a cure is sure to go up accordingly and, hence, its adoption rate for wound care products. Diabetic foot ulcers are also chronic and need long-term management to prevent the extreme complications like infections and amputations. So, enhanced patient and provider awareness continues to enhance demand for DFU treatment products which has led to the expansion of the international diabetic foot ulcer treatment market.

What are the significant challenges impacting the Diabetic Foot Ulcer Treatment Market?

High Treatment Costs and Prolonged Recovery Times

The high costs associated with diabetic foot ulcer treatment products significantly limit their widespread use and hinder market expansion. The lengthy healing process for these wounds, along with the frequent need for dressing changes, places a considerable financial strain on patients and healthcare systems alike in both advanced and developing nations. For instance, a 2023 article in the Journal of Wound Care highlighted that healing a stage 4 diabetic foot ulcer can take an average of 190 days. This extended duration can negatively affect the quality of life for patients and create challenges for caregivers. However, many developed nations are beginning to implement reimbursement policies for diabetic foot ulcer treatments, which are expected to enhance market resilience and support future growth.

What are the attractive investment opportunities that can drive industry growth?

Technological Innovations in Diabetic Foot Ulcer Treatment

Technological advances in diabetic foot ulcer management require good outcomes for the patient. The U.S. Food and Drug Administration has approved many advanced wound care products, including bioengineered skin substitutes and smart dressings that NIH, citing can be applied to reduce healing times by as much as 50% compared to the old methods. Technology in telehealth is also increasing, with the Centers for Medicare & Medicaid Services reporting that telehealth visits increased by 150% in the pandemic to also increase prompt remote consultations. According to the Journal of Diabetes Science and Technology, a study has further proved that in high-risk patients, the incidence of ulcers can be reduced as much as 70% through mobile health applications. Such innovations point to potential improvements on treatments regarding effectiveness and accessibility for diabetic foot ulcers.

North America Plays a Crucial Role in the Diabetic Foot Ulcer Treatment Market Landscape

The region of North America is one of the main pioneer regions in terms of diabetic foot ulcer treatment. The primary reason for this is the area's high rate of diabetes. The region also boasts a well-developed health infrastructure, intensive research and development, and active patient advocacy networks. It is estimated that the Centers for Disease Control and Prevention report 38.1 million adults in the United States are living with diabetes, which is proven to increase the risk of foot ulcers markedly.

The region is further committed to early adoption of innovative treatment options and comprehensive healthcare coverage, which drives market growth. Advanced wound care products, including antimicrobial dressings and bioengineered skin substitutes, find new fuel in the scope of researched works being funded by organizations like NIH. Innovations within these areas advance to meet the changing needs of patients as well as their service providers and continue to improve treatments.

Additionally, the American Diabetes Association projects that up to 25% of patients with diabetes will experience a foot ulcer at some point in their life. There is, therefore, great need for an effective treatment solution. This brings together all the factors that make North America a crucial market in the diabetic foot ulcer treatment market.

Read more about the report: https://www.metatechinsights.com/industry-insights/diabetic-foot-ulcer-treatment-market-1075

Asia-Pacific, Particularly China and India, Holds a Significant Share of the Diabetic Foot Ulcer Market

Increasing awareness about complications arising from diabetes and the rise in healthcare expenditure is highly developing growth opportunities for the Diabetic Foot Ulcer Treatment market in the Asia Pacific region. The Asia Pacific region, with countries such as China and India, is experiencing a growing rate of obesity; this, in turn, increases the risk of developing diabetic foot ulcers. The International Diabetes Federation has reported up to 116 million adults suffering from diabetes in China and 77 million in India. This suggests the existence of a huge population at the risk of complications arising in the foot.

Advanced wound care technologies, such as hydrocolloid dressings and bioengineered skin substitutes, have rendered the treatment more accessible with the improvement in the health infrastructure. Local government initiatives are also important in developing this market by creating an awareness of the management of diabetes. The Indian government has been active in conducting the National Health Mission that puts forth policies toward making diabetes prevention programs more publicized and effective.

By increasing the partnerships between local manufacturers and international companies, and increasing the availability of products, with competitive prices, diabetic foot ulcer treatments cater to more significant portions of the market. In aggregate, these components further propel the growth of the diabetic foot ulcer treatment market in Asia-Pacific.

Competitive Landscape

The diabetic foot ulcer treatment market is segmented with multiple players competing in the market by launching new products and strategic collaborations. Among the leading companies are Coloplast Corp., Convatec Inc., Integra LifeSciences, B. Braun SE, and Cardinal Health. New developments in the field are reported as Convatec buys KCI, an advanced wound care company, broadening its portfolio of innovative products in the management of wounds.

Strategic collaborations have led the company to develop new bioengineered skin substitutes. Coloplast Corp. has recently launched a new range of hydrocolloid dressings that are primarily supposed for use on diabetic foot ulcers. All these activities fall within an innovative environment that is competitive, wherein strategic growth is also enhanced through improvements in diabetic foot care outcomes.

Recent Developments

- In May 2024, Discovery Therapeutics Caribe, a biotechnology company in Cleveland, is set to investigate a Cuban-developed treatment for diabetic ulcers. Originally created two decades ago, this drug is licensed in 26 countries for treating large pressure ulcers on the feet of diabetes patients with poor circulation, helping them heal difficult wounds.

- In May 2023, Convatec Inc. has received U.S. FDA approval for its InnovaBurn placental extracellular matrix device, designed to treat complex surgical wounds and burns, including partial thickness second-degree burns. It is also applicable for diabetic ulcers, expanding Convatec's product offerings for challenging wound care.

Report Coverage:

By Product Type

- Wound-care Dressings

- Antimicrobial Dressings

- Foam Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Other Dressings

- Wound-care Devices

- Negative Pressure Wound Therapy (NPWT)

- Ultrasound Therapy

- Hyperbaric Oxygen Therapy (HBOT)

- Others

- Active Therapies

- Skin Grafts & Substitutes

- Growth Factors

- Others

By Ulcer Type

- Neuropathic Ulcer

- Ischemic Ulcers

- Neuro-ischemic Ulcer

By Infection Severity

- Moderate

- Mild

- Severe

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

By Region

North America

- U.S.

- Canada

Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Singapore

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

List of Companies:

- Coloplast Corp.

- Convatec Inc. (U.S.)

- Integra LifeSciences (U.K.)

- B. Braun SE (Germany)

- Cardinal Health (U.S.)

- Mölnlycke Health Care AB (Sweden)

- Essity Aktiebolag (publ). (Sweden)

- Medline Industries, LP.

- MIMEDX

- URGO MEDICAL Australia Pty Ltd

- Smith & Nephew Plc

- Tissue Regenix

- Organogenesis Inc.

- Medtronic plc.

- BSN Medical GMBH

Maximize your value and knowledge with our 5 Reports-in-1 Bundle - over 40% off!

Our analysts are ready to help you immediately.