Research Process

Metatech Insights employs a rigorous and dynamic research methodology, designed to ensure the utmost accuracy and precision in our market analyses. By leveraging a combination of primary and secondary data sources, our research delves deep into the factors shaping the industry. We meticulously examine a broad spectrum of influences, including government policies, competitive landscapes, historical data, and the current market environment. Additionally, we analyze emerging trends, technological innovations, and the advancements driving industry evolution. Our approach also accounts for market risks, opportunities, barriers, and challenges, providing a comprehensive understanding of the market's future trajectory.

Market Size Estimation

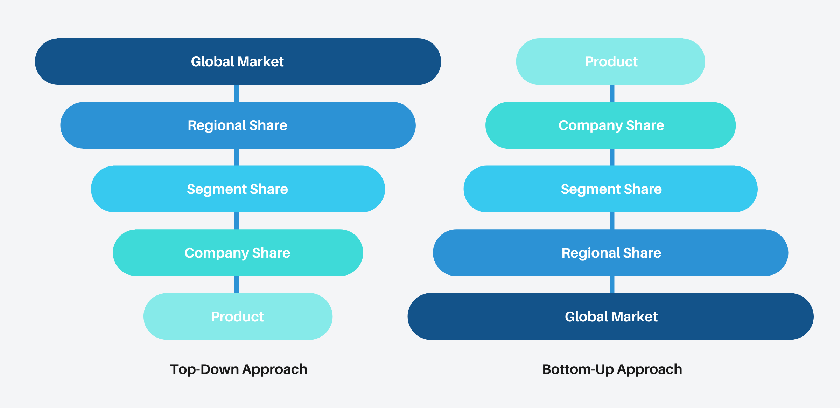

At Metatech Insights, we employ both top-down and bottom-up approaches to ensure the most accurate and reliable market size estimations. These methods allow us to assess the market at both a macro and micro level, calculating the market size for companies, regional segments, product categories, and end-user applications.

Our estimations are based on the market's sales price (excluding discounts from distributors, wholesalers, or traders) and are further refined by analyzing percentage splits, market share, and the utilization rates of each product segment. The regional breakdowns are drawn from the adoption and usage rates of the products in specific regions or countries, providing localized insights.

To pinpoint the major players and determine their market revenues, we rely on a combination of secondary research (such as annual and financial reports) and primary research (in-depth interviews with key opinion leaders, industry experts, and high-level executives). This dual-pronged approach ensures that the data we present on market share, growth rates, and segment breakdowns is both comprehensive and verified.

Every possible factor influencing the market—from technological advancements to competitive shifts and regulatory changes—has been scrutinized, verified through primary sources, and rigorously analyzed. While we account for a wide range of variables, our market size forecasts exclude unpredictable external factors such as economic downturns and sudden regulatory changes.

The result is a precise and normalized view of the market, combining quantitative data with qualitative insights. These findings, enriched by detailed inputs from our research team at Metatech Insights, are presented in this report to provide actionable intelligence for strategic decision-making.

Data Triangulation and Validation

After completing a comprehensive market engineering process—which included precise calculations for market statistics, detailed market size estimations, forecasting, segment breakdowns, and robust data triangulation techniques—an extensive phase of primary research was undertaken. This step was crucial in gathering additional information and ensuring the validation and accuracy of all critical data points derived during the engineering process.

Throughout this analysis, we employed both top-down and bottom-up approaches in parallel with multiple data triangulation methods. These combined methodologies allowed us to perform market estimations and forecast future trends across all key market segments and sub-segments, ensuring a nuanced understanding of the market dynamics.

To further enhance the accuracy and depth of the study, we incorporated extensive qualitative analysis alongside the quantitative results. This dual-layered approach enabled us to verify the reliability of the data and provided a more granular understanding of underlying market trends. Every data point generated during the market engineering process was thoroughly scrutinized and analyzed, allowing us to present a well-rounded report that not only captures the statistical essence of the market but also provides deeper strategic insights. This structured methodology ensures that key information, derived from both numerical calculations and expert analysis, is effectively highlighted throughout the report for a more informed decision-making process.

Data Sources

In this research study, a comprehensive array of secondary sources was utilized to ensure an in-depth and accurate analysis of the market. These sources included a wide variety of credible and authoritative data such as press releases, annual reports, industry association publications, non-profit organizations' reports, government agency findings, and customs data. The study also leveraged an extensive collection of directories and databases such as Bloomberg Business, Wind Info, Hoovers, Factiva (Dow Jones & Company), and Trading Economics, along with News Network, Statista, Federal Reserve Economic Data, BIS Statistics, ICIS, company house documents, CAS (American Chemical Society), investor presentations, and SEC filings. These secondary research sources were instrumental in gathering valuable information on top companies, classifying the market, and identifying key market trends, segmentation, and technological developments down to the most granular level.

In parallel, primary research played a vital role in adding a deeper layer of qualitative and quantitative insights. To gather firsthand information, we conducted extensive interviews with both supply and demand-side experts. From the supply side, interviews were held with key industry players, including product companies (and their competitors), opinion leaders, industry experts, research institutions, distributors, dealers, traders, raw materials suppliers, and producers. On the demand side, we gathered insights from a wide range of professionals, such as business leaders, marketing and sales directors, technology and innovation directors, supply chain executives, and product end users from various leading companies operating in the global market.

This combination of primary and secondary research allowed us to dive deep into various facets of the market, including product segmentation, raw material sourcing, key company strategies, and downstream demand. The primary research process also helped us identify and analyze industry dynamics, including risks, influencing factors, opportunities, market barriers, trends, and strategic approaches employed by key players. By incorporating both qualitative and quantitative insights, our research provides a comprehensive and actionable understanding of the current market landscape and future outlook.

Maximize your value and knowledge with our 5 Reports-in-1 Bundle - over 40% off!

Our analysts are ready to help you immediately.